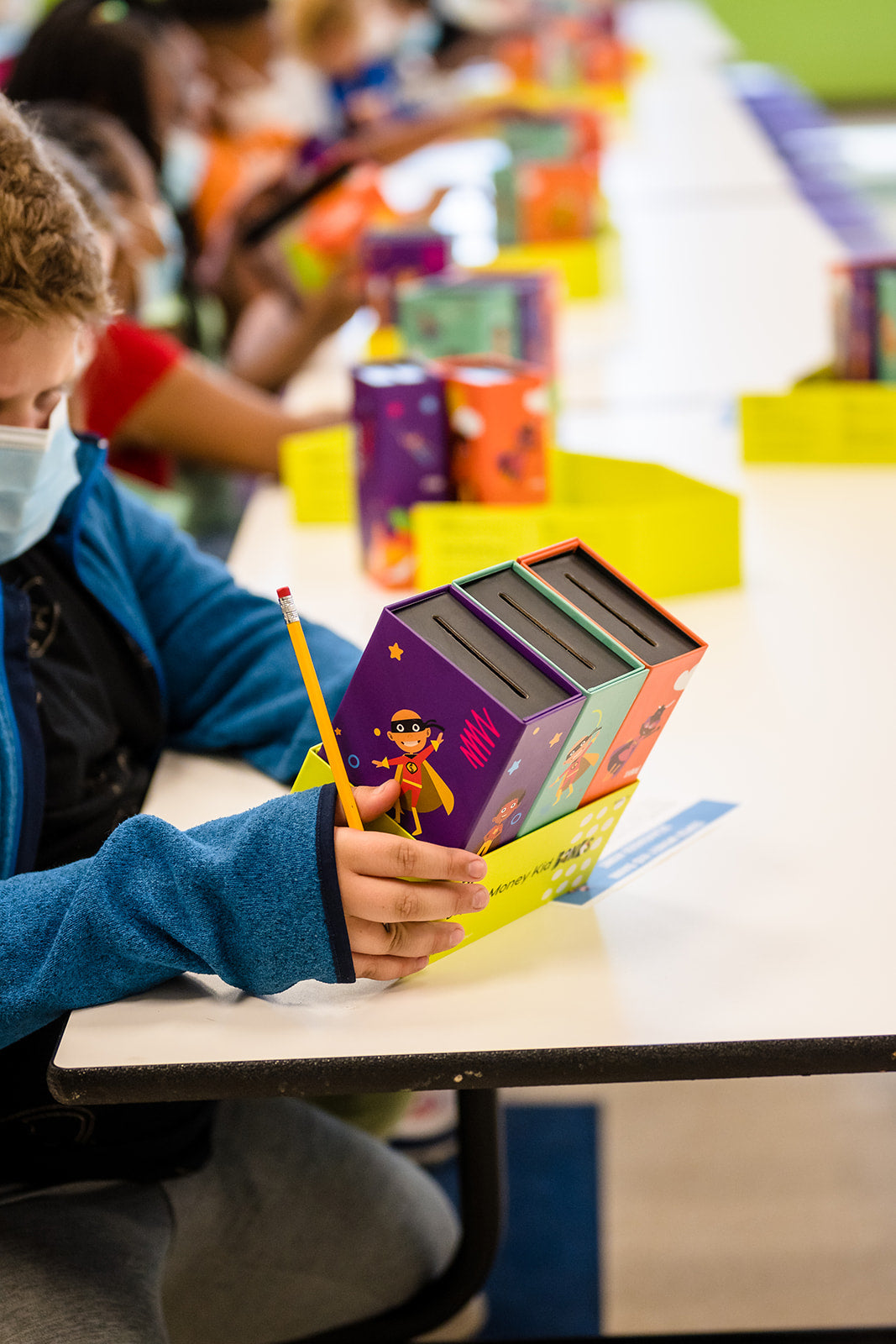

Super Money Kids In School

In addition to the economic benefits, financial literacy helps develop higher order thinking skills, it promotes social-emotional development and gives hope to communities where hope may not have existed before.

Watch VideoRequest A DemoK-6th Grade

Super Money Kids Module 1: The 6-lesson curriculum introduces students to the world of personal finance through 3 money habits: Saving, Spending and Sharing. Module 1 helps students develop good money habits while enabling students to exercise their numeracy skills, develop pride in their identity and set goals for the future. The Super Money Bank is used as an instructional resource throughout the program. Each lesson is 35-45 min.

Kiddonomics: This 4-lesson curriculum was originally designed to assist Tennessee elementary schools in satisfying a sub-group of Social Studies standards focused on economics. Beyond the economic lessons of supply and demand, consumers and producers and goods and services, this module teaches students how to make informed decisions which is a critical thinking skill that students can use throughout their personal and professional lives.

7th-12th Grade

Super Money Teens: A digital curriculum designed to prepare teens for life after graduation. This 4-lesson module covers needs vs wants for teens, building credit, financial prep for college and payroll deductions. It includes videos and exercises to be facilitated in a group.*Super Money Teens is expanding to include a special 5-lesson series on the digitization of our money. It will also include lessons on creating spending plans, buying a car and entrepreneurship. Available Fall 2022.

Request A DemoPost-Secondary:

Super Money University: A digital, self-paced financial education course for colleges and universities. It includes videos, exercises, quizzes and optional in- person presentations. This programming option is customizable from a series of 16 lessons including understanding student loans and repayment plans.

Request A Demo

REQUEST A DEMO

Accessing Our Library

Already a member? Sign in now to access the Super Money Kids library.

Courses Login